Today's Challenges

Have no Income Protection.

Have less than $25.000 saved for retirement.

Is what the average America Household has.

A PERSONALIZED STRATEGY FOR FINANCIAL SECURITY.

If you’re like many people, you’re in the dark about your finances. You pay your bills each month and do your best to prepare for the future. But the truth is, there’s only so much money to go around and preparing for the future can be overwhelming.

According to Wikipedia, Personal finance is the financial management which an individual or a family unit performs to budget, save, and spend monetary resources over time, taking into account various financial risks and future life events.

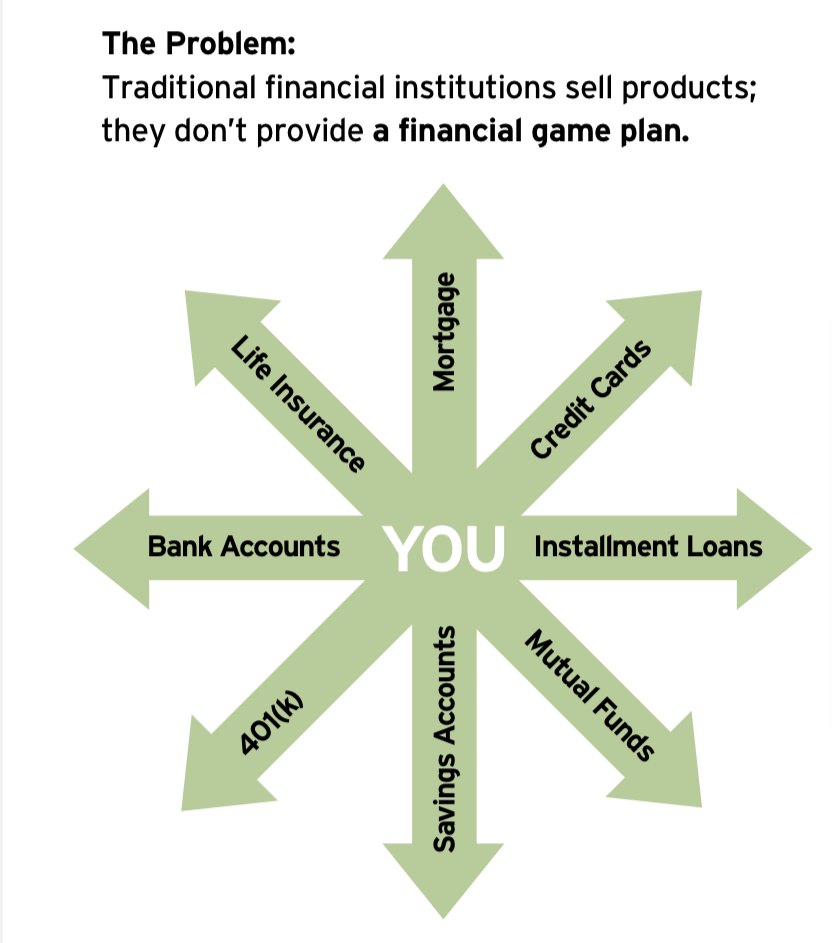

When planning personal finances, the individual would consider the suitability to his or her needs of a range of banking products (checking, savings accounts, credit cards and consumer loans) or investment private equity, (stock market, bonds, mutual funds) and insurance (life insurance, health insurance, disability insurance) products or participation and monitoring of and- or employer-sponsored retirement plans, social security benefits, and income tax management.

One of the most important building blocks in establishing a firm financial foundation is determining the difference between “wants” and “needs.” A “want” is something you don’t require for basic survival and a “need” is something you must have to live. Yet, sometimes it can be hard to tell where a “want” begins and a “need” ends – especially where immediate family is concerned. Financial health is all about the choices you make over the long term. Also you need all this financial blocks to work together as one toward your benefit, not theirs.